The donor-advised fund (DAF) is becoming an increasingly popular way to make a charitable gift. DAFs can provide you with immediate tax benefits while making your charitable giving easier.

How it works! Establish a fund at a sponsoring entity. DAF sponsors are considered charities. A sponsoring entity could be a community foundation, a public charity with a donor-advised fund program, or even one of the well-known investment companies that sponsor donor-advised funds.

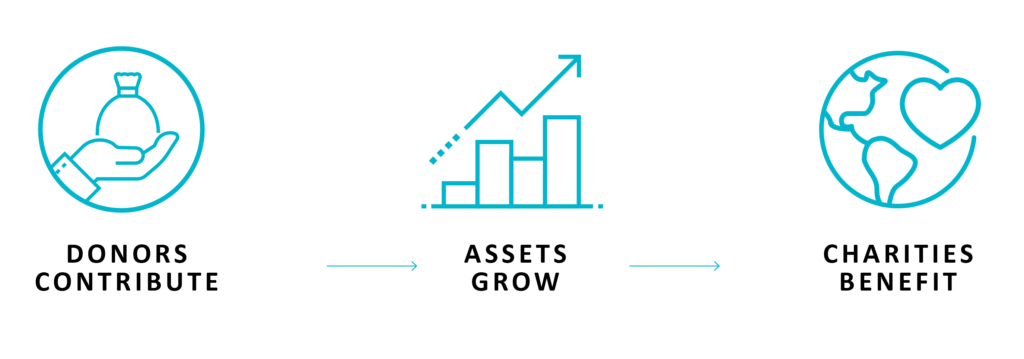

First, check with a fund sponsor about the minimum contribution to start a fund. Then, make an initial contribution of cash or appreciated assets such as stocks or mutual funds, or sometimes even non-publicly traded assets like private business interests to start your fund. Because you are opening an account at a charity, you’ll get an immediate income tax deduction. Once invested in your DAF, the funds will grow tax-free. You can also add to your DAF over time. Most sponsors will even let you name your fund.

Make a Gift with a Donor-Advised Fund

Here are two simple ways you can make a gift through your DAF:

1. Make an outright gift by suggesting a grant to Freeport Conservation Trust: Contact your fund administrator to request a distribution or download the distribution form from your administrator’s website.

2. Designate FCT to receive all or a portion of the fund value upon the termination of the fund (name Freeport Conservation Trust as a successor):

While a DAF is intended for you to spend it down on charitable contributions during your life, it can be hard to ensure the account is zeroed out at your death, especially because funds in the account grow tax-free.

You can name a charitable entity (or several entities) as a successor, and they will receive the remainder of your account. If you do not select a successor, at termination the account reverts to the DAF sponsor for them to distribute at a time and to the charitable entity of their choosing (not yours).

By selecting FCT as a successor of the remainder of your DAF account, you are making a significant impact on the work of your local land trust, right here in Freeport. Contact your fund administrator to request a successor (beneficiary) designation form or complete the successor designation process online.

Freeport Conservation Trust is grateful for gifts that come from donor-advised funds. To help you make a gift to FCT from your DAF use our legal name- Freeport Conservation Trust and federal tax ID #01-0357213.

Once established, you can suggest that your favorite public charities, such as Freeport Conservation Trust, receive grants from your fund. The grants can be relatively modest (set up annually to support the alumni fund) or larger for projects such as a land protection or stewardship campaign.

As a result of the increased standard deduction in the Tax Cuts and Jobs Act of 2017, fewer people itemize deductions for their charitable gifts. Making a larger donation to your DAF in a given tax year can increase your federal deductions above the standard deduction level and allow you to itemize. In subsequent years you can then take the standard deduction while continuing to support your favorite charities via grants from your DAF. You do not get an additional tax deduction for these grants. You can also suggest which charities you want to have any remaining assets in your fund at your passing.